The Trump administration’s tariff policies brought lasting changes to the financial and operational strategies of multinational enterprises (MNEs). While initially framed as a move to protect American industries, the ripple effects transformed balance sheets, income statements, cash flow structures, and global strategic decision-making. 1. Balance Sheet Transformation Inventory Inflation and Asset Realignment The sudden increase in import costs—especially on goods from China—led to a sharp rise in inventory valuations. Companies stockpiled critical components in anticipation of further tariffs, which caused: Capital Structure Shifts To adjust, firms: 📊 Multidimensional Tariff Impact by Industry Visualizing the intensity of tariff impacts across industries in key financial areas. 2. Profitability Under Pressure Rising Cost of Goods Sold (COGS) Tariff-induced hikes in raw material prices...

In the shadow of the 2008 mortgage meltdown, a new lending disaster is brewing—not from subprime homebuyers, but from systemic failures in commercial credit underwriting. As US regional banks report commercial loan delinquency rates hitting 4.7% (FDIC Q1 2025), our investigation reveals how flawed due diligence, approval shortcuts, and lax monitoring are creating a $600B time bomb in SME lending. Here’s what’s broken, why it matters, and how to protect your institution. I. The Three Pillars of Credit Failure 1. Due Diligence: The Art of Seeing Without Looking Current Practices Critical Gaps Case Study:A Texas equipment lender approved $28M for “oilfield services” startups—later found to be shell companies recycling the same bulldozers. 2. Approval Processes: When Speed Trumps Safety The Compliance Mirage...

In the high-stakes world of public markets, financial statements are both a compass and a camouflage. While regulators like the SEC have tightened scrutiny post-Enron, creative accounting persists—now with subtler tricks. From inflated cash balances to phantom inventory, here’s how to detect financial shenanganas in US-listed companies, armed with real case studies and forensic accounting techniques. 1. The Cash Conundrum: When “Liquid Assets” Aren’t Liquid Warning Signs: Forensic Tools: 2. Accounts Receivable: The Art of Fictional Sales Telltale Patterns: Case Study:Valient Pharma booked $150M in AR from “Bahamas-based clients”—later exposed as shell companies. 3. Inventory: Where Profits Go to Hide Red Flags: Detection Tactics: 4. Capex Mirage: The “Build It and They Won’t Come” Strategy Warning Signs: Spotting Phantom Assets: 5....

In the high-stakes theater of corporate America, quarterly business reviews (QBRs) are where strategies live or die. For finance professionals, these meetings present a paradox: You’re the guardian of truth in numbers, yet overstepping can breed resentment. Drawing from interviews with 50+ CFOs, here’s how top finance teams navigate the “4 Must-Wins” and “4 No-Fly Zones” to maximize impact while staying in their lane. Part 1: The 4 Battles Finance Should Own 1. Data Integrity: Your Non-Negotiable Credibility Why It Matters: How to Win: 2. Insight Generation: From “What” to “So What” The Gold Standard: Tools for Depth: 3. Actionable Prescriptions: CFOs as Fixers, Not Historians Case Study:When a SaaS firm’s CAC ratio spiked, the CFO proposed: Template for Recommendations:...

When President Trump announced sweeping tariffs of up to 54% on 60 nations this April 2nd—dubbing it “Economic Independence Day”—he triggered the most dramatic trade realignment since the 1930 Smoot-Hawley Act. Here’s what every American consumer, investor, and business leader needs to know about the coming shockwaves. I. The Tariff Blueprint: Who Pays What 1. The Two-Tiered Hammer 2. Automotive Armageddon II. The Domino Effect: Three Immediate Crises 1. Consumer Price Surge 2. Market Meltdown 3. Global Retaliation III. The Grand Illusion: Trump’s Three Miscalculations 1. “Made in America” Mirage 2. The $6 Trillion Fantasy 3. Supply Chain Anarchy IV. Survival Strategies for Different Americans 1. Consumers 2. Investors 3. Business Leaders V. Historical Parallels: Are We Repeating 1930? Factor1930...

In the U.S., where Sarbanes-Oxley (SOX) compliance and operational efficiency are non-negotiable, poor finance team structuring isn’t just inconvenient—it’s a legal and financial time bomb. Yet, many companies repeat the same mistakes, from startups mimicking “lean teams” to corporations drowning in bureaucracy. Here’s a breakdown of eight critical missteps, adapted for American business realities, and how to fix them. 1. The “Swiss Army Knife” Finance Team: Multitasking Gone Wrong The Trap:A single employee handles accounts payable, payroll, and tax filings to “cut costs.” Sound familiar? This violates the foundational segregation of duties principle. U.S. Context: Fix: 2. Job Descriptions: Vague as a Horoscope The Trap:“Perform finance-related tasks” is as useless as a screen door on a submarine. Ambiguity invites chaos. U.S. Adaptation: 3. Excel...

The Five Pillars of Business Accounting 1. Sources of Capital: The Funding Equation Every dollar entering your business falls into one of two categories: Liabilities (Borrowed Funds) Owners’ Equity (Invested Capital) Real-world example: Tech startup NeoVision raised 5M—5M—2M from angel investors (equity) and $3M as convertible notes (debt). 2. Cash Deployment: The Spending Matrix Expenses (Immediate Consumption) Assets (Long-term Value) Pro Tip: The $10,000 laptop rule—items under this threshold can often be expensed immediately under IRS guidelines. 3. Asset Utilization: Value Conversion Paths Inventory Conversion Depreciation Schedules Asset Type Standard Lifespan Commercial buildings 39 years Office equipment 5-7 years Software systems 3 years Amortization Patterns 4. Revenue Realization: The Profit Engine The Sales Cycle Profit/Loss Determinants Case Study: Midwest Manufacturing improved margins from 12%...

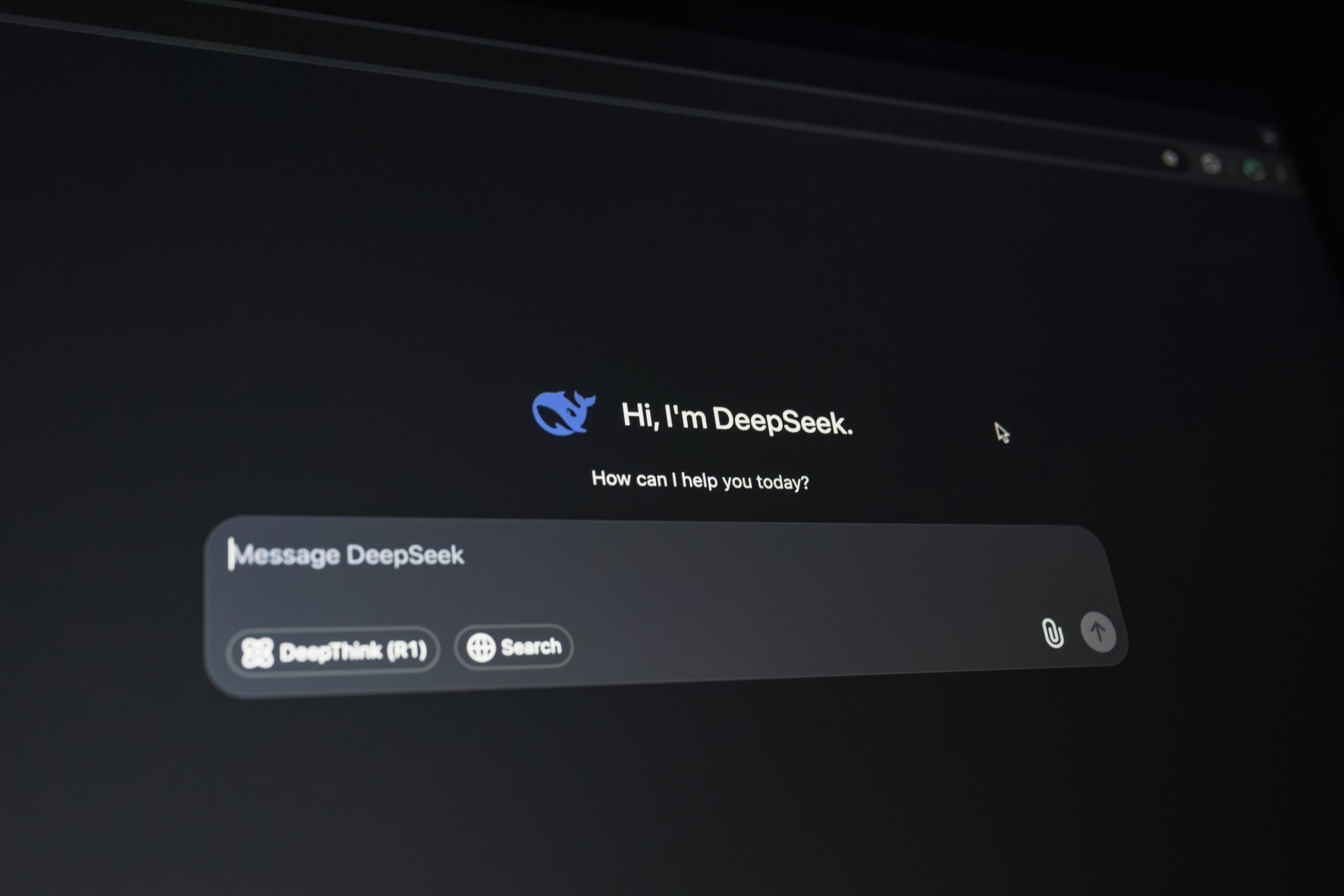

The rapid advancement of artificial intelligence (AI) and big data technologies is transforming financial services globally. In China, DeepSeek—a cutting-edge AI platform developed domestically—has emerged as a game-changer for the banking sector, particularly in credit services. This white paper examines how DeepSeek is reshaping credit processes across three critical phases: pre-loan assessment, in-loan risk management, and post-loan collections. Through real-world case studies from Chinese commercial banks, we demonstrate how this technology enhances risk control, operational efficiency, and customer experience while creating new business models. For North American financial institutions observing China’s fintech evolution, this analysis provides valuable insights into: Section 1: The DeepSeek Advantage in Credit Risk Management 1.1 Technical Architecture DeepSeek integrates multiple advanced AI capabilities: 1.2 Comparative Advantage...

The Profitability Blueprint Hidden in Financial Statements In today’s volatile economic climate, the ability to extract meaningful insights from financial statements has become an indispensable skill for investors, analysts, and corporate leaders. The income statement, often overshadowed by flashy balance sheet metrics or cash flow projections, actually contains the most revealing narrative about a company’s competitive position and operational efficiency. This comprehensive guide will transform how you interpret profitability metrics, moving beyond surface-level analysis to uncover the strategic truths buried in financial data. We’ll examine five critical profitability indicators, explain their interconnected relationships, and reveal what they truly communicate about a company’s market position and management quality—with real-world examples from North American markets. Section 1: The Fundamental Profitability Indicators 1....

The Fine Art of Financial Diplomacy In the high-stakes world of corporate finance, professionals often walk a tightrope—balancing risk management, compliance, and business objectives while protecting themselves from undue blame. A poorly worded email, an ambiguous approval, or an undocumented conversation can turn a routine transaction into a career liability. This guide provides tactical communication strategies for finance teams, helping them document decisions, set boundaries, and maintain professionalism in high-pressure situations. Whether you’re flagging contract risks, navigating business pivots, or staying neutral in negotiations, these “bulletproof phrases” will help you communicate clearly while covering your bases. 1. Verifying Information & Flagging Risks Scenario: A sales team submits a contract with questionable payment terms. You need to confirm details while documenting your risk warnings. Pro Phrase: “After...

SinoLoanHub: Expert Business Loan Solutions for North American Companies

SinoLoanHub: Expert Business Loan Solutions for North American Companies