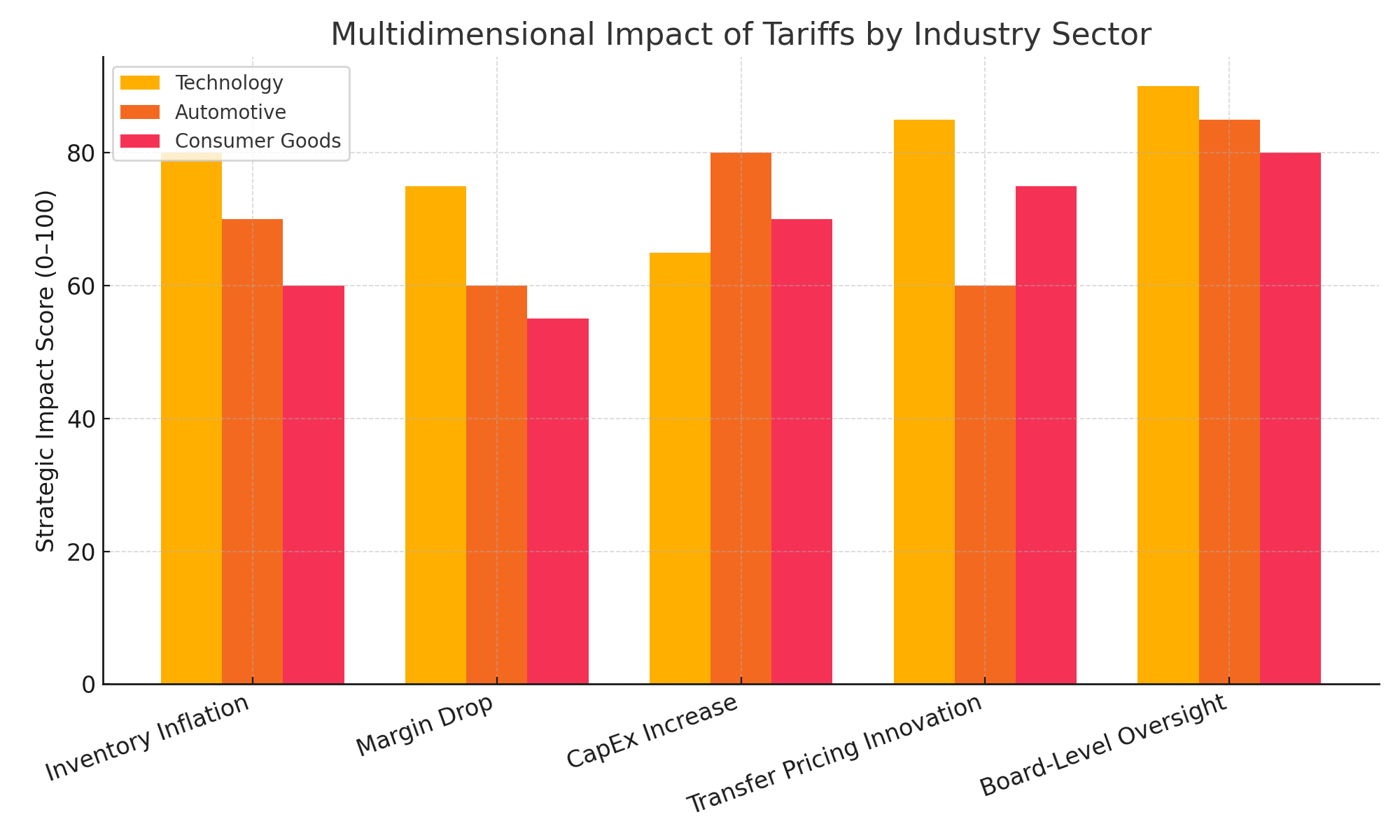

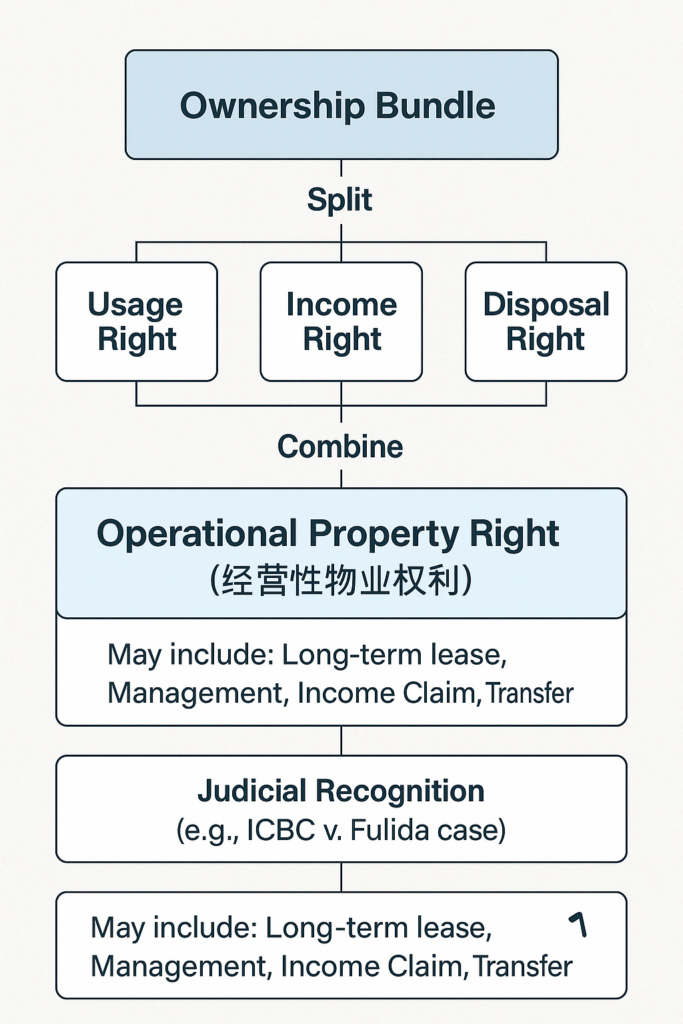

What Are Operational Property Rights?

Operational property rights are widely used in real transactions in China, yet they lack official classification as real rights in the Civil Code. These rights involve the ability to use, benefit from, and dispose of a property—essentially splitting the ownership bundle.

They are functionally similar to usufructuary rights, and often include income rights, leasing rights, and disposal rights without requiring ownership.

Are They Protected by Law?

Yes. While not explicitly listed among the five statutory usufructuary rights (land management rights, construction land use rights, homestead rights, residence rights, easements), Chinese courts have recognized their legal protection.

📚 Case Study:

In ICBC Harbin Branch v. Harbin Fulida Public Facilities Co. (Gazette 1998(000)002), the court upheld that leasing and management rights over an underground commercial property were valid usufructuary rights and could serve as mortgage collateral.

Can They Be Used as Collateral?

Yes. Although operational rights don’t constitute ownership, courts have ruled that they may serve as mortgage assets, similar to how contracted wasteland use rights can be mortgaged with consent.

✅ Legal Basis Referenced:

- Articles 4, 7, 55 of the General Principles of Civil Law

- Article 34 of the Security Law

➡️ In practice, if the rights are valuable and not prohibited by law, they can support loan agreements when registered transparently.

Mortgage or Pledge?

Operational property rights are often recorded as intangible assets in accounting books. While they do not qualify as pledgable rights (per Art. 440), they may qualify for mortgage registration under Civil Code Article 395.

| Classification | Qualify? | Legal Support |

|---|---|---|

| Mortgage (Art. 395) | ✅ Yes | Not prohibited, value-supported |

| Pledge (Art. 440) | ❌ No | Not in enumerated list |

Loan Classification in Practice

Should banks treat loans backed by management rights as income-producing property loans?

❌ Not quite.

🔎 Why not:

- Borrowers do not own the property, only manage it.

- The asset is recorded as an intangible, not real estate.

- It may inflate real estate loan numbers misleadingly.

📌 Regulatory Insight:

The CBIRC’s 2023 draft “Three Measures, One Regulation” allows patent loans to follow fixed-asset loan rules. By analogy, operational rights-backed loans could follow a similar model.

Enforcement: What Happens When Borrowers Default?

📚 Example:

In Guilin Tongde Real Estate v. Chongqing Jinshan Hotel (SPC Gazette 1999(05)), the court ruled that operational rights could be:

- ✅ Assigned to creditors

- ✅ Applied toward debt repayment

- ✅ Auctioned or entrusted for income continuity

This shows how creditors can legally enforce these rights without needing ownership transfer.

Recommended Tools 🧰

Final Takeaway

Operational property rights, while unofficial in legal classification, carry real financing power and are being judicially validated in China. Banks and borrowers can leverage them through careful documentation, risk assessment, and legal structuring.

👉 Explore how your property rights can support a real-world loan →

SinoLoanHub: Expert Business Loan Solutions for North American Companies

SinoLoanHub: Expert Business Loan Solutions for North American Companies