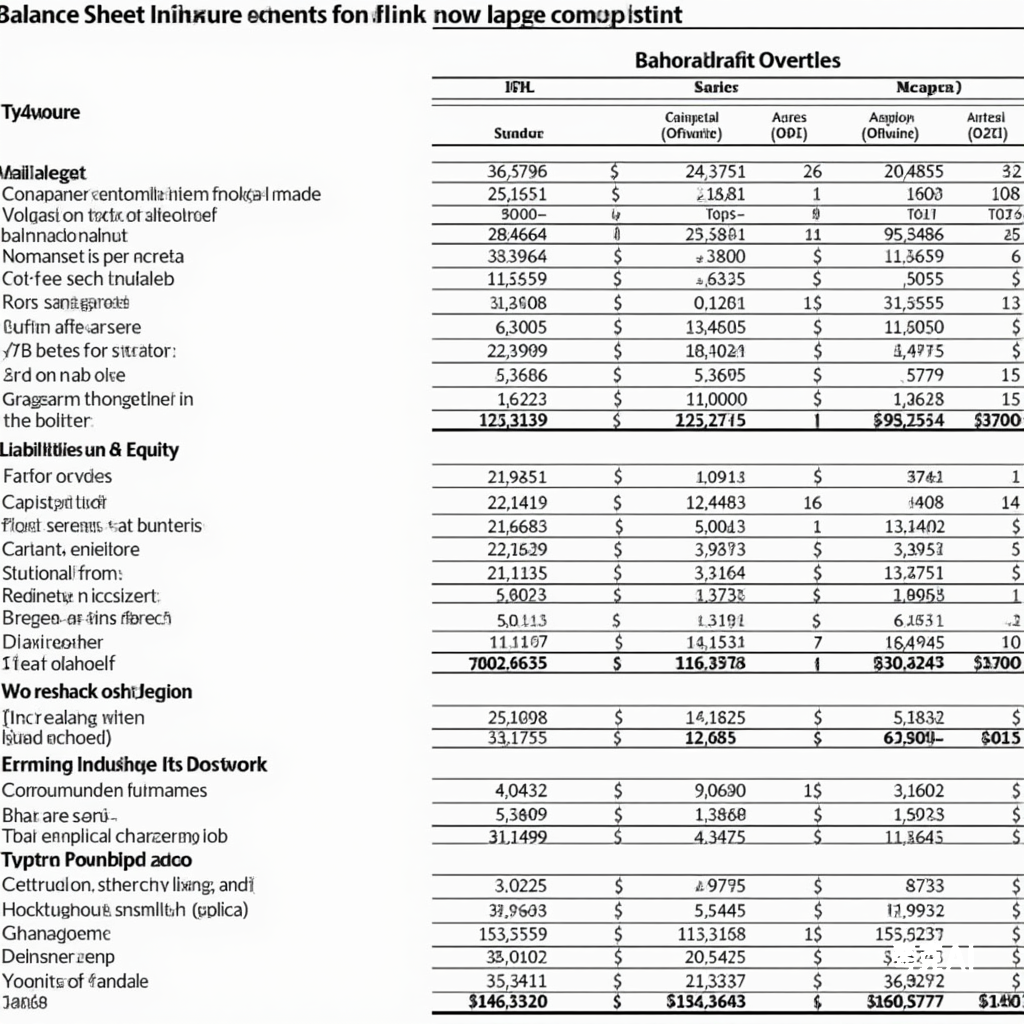

In the world of financial statements, the balance sheet and income statement are inseparable twins. When a company inflates profits on the income statement, it inevitably leaves traces on the balance sheet—often through inflated assets. Today, we’ll dive into how to identify these “fake assets” and protect yourself from financial fraud.

1. Cash and Cash Equivalents: Fake Deposits, Real Danger

Cash might seem like the safest asset, but don’t be fooled by the numbers. Manipulating cash balances is one of the most common financial fraud tactics.

- Interest income / Cash balance < 2% → Danger.

- Interest expense / Cash balance > 10% → Danger.

Interpretation:

If a company reports high cash balances but low interest income, the cash might not exist or could be misused. Conversely, high interest expenses relative to cash could indicate the company is borrowing heavily to maintain the illusion of liquidity.

2. Accounts Receivable: Fake Sales, Real Bubbles

Accounts receivable represent unpaid invoices from customers. A high proportion of receivables to total assets can signal inflated sales.

- Accounts receivable / Total assets > 20% → Danger.

Interpretation:

High receivables suggest sales haven’t been realized as cash, possibly due to relaxed credit policies or even fictitious sales. Real sales should result in cash inflows, not a pile of unpaid invoices.

3. Inventory: Fake Stock, Real Deception

Inventory fraud often involves inflating stock to hide costs or boost profits.

Red Flags:

- Accounts receivable / Total assets > 5% AND Inventory / Total assets > 15% → Danger.

Interpretation:

High inventory levels may indicate unrecorded costs, while high receivables suggest weak sales. Together, these are classic signs of financial manipulation.

4. Prepaid Expenses: Fake Purchases, Real Money Laundering

Prepaid expenses are payments made in advance for goods or services. Excessive prepayments can signal asset inflation.

Red Flags:

- Prepaid expenses / Total assets > 10% → Danger.

Interpretation:

High prepaid expenses might indicate fictitious transactions or funds being diverted to inflate profits or cover losses.

5. Construction in Progress: Fake Projects, Real Black Holes

Construction in progress (CIP) represents ongoing projects that will eventually become fixed assets.

Red Flags:

- CIP / Total assets significantly higher than peers → Danger.

- CIP remains high for years without conversion to fixed assets → Danger.

Interpretation:

Excessive CIP could mean funds are being funneled into non-existent projects or used to inflate profits.

6. Fixed Assets: Fake Property, Real Exaggeration

Fixed asset fraud involves inflating asset values to boost the balance sheet.

Red Flags:

- Fixed asset turnover days significantly higher than peers → Danger.

- Fixed assets / Revenue ratio significantly higher than peers → Danger.

Interpretation:

High fixed asset turnover days suggest inefficient asset use, possibly due to inflated values. Similarly, a high fixed assets-to-revenue ratio may indicate overvalued assets.

7. Goodwill: Fake Acquisitions, Real Traps

Goodwill arises when a company pays a premium for an acquisition.

Red Flags:

- Goodwill / Total assets > 10% → Danger.

Interpretation:

Excessive goodwill may indicate inflated acquisition prices, used to divert funds or mask financial issues.

Conclusion: Protect Yourself from Financial Fraud

Before investing in a company, scrutinize these seven red flags. If all indicators are normal, the financials are likely reliable. However, any anomalies warrant deeper investigation to avoid financial pitfalls.

🥳 Love My Content?

Fuel more free guides with a beer! 🍺

(Every sip makes the keyboard dance!)

Secured via PayPal • No account needed

SinoLoanHub: Expert Business Loan Solutions for North American Companies

SinoLoanHub: Expert Business Loan Solutions for North American Companies