Zero-cost financing is rapidly becoming a go-to strategy for modern entrepreneurs. In 2025, businesses are discovering new ways to raise capital without traditional loans, high interest rates, or giving up ownership. This guide explores proven zero-cost financing methods that help you unlock growth—while keeping every dollar in your pocket.

Yes, it’s real. Yes, it’s legal. And yes, you don’t need to risk your house.

Imagine this: you’ve built a strong business plan and need $1 million to execute it. But all you have is $100,000. Do you borrow from friends? Take out a bank loan? Sell half your company to investors?

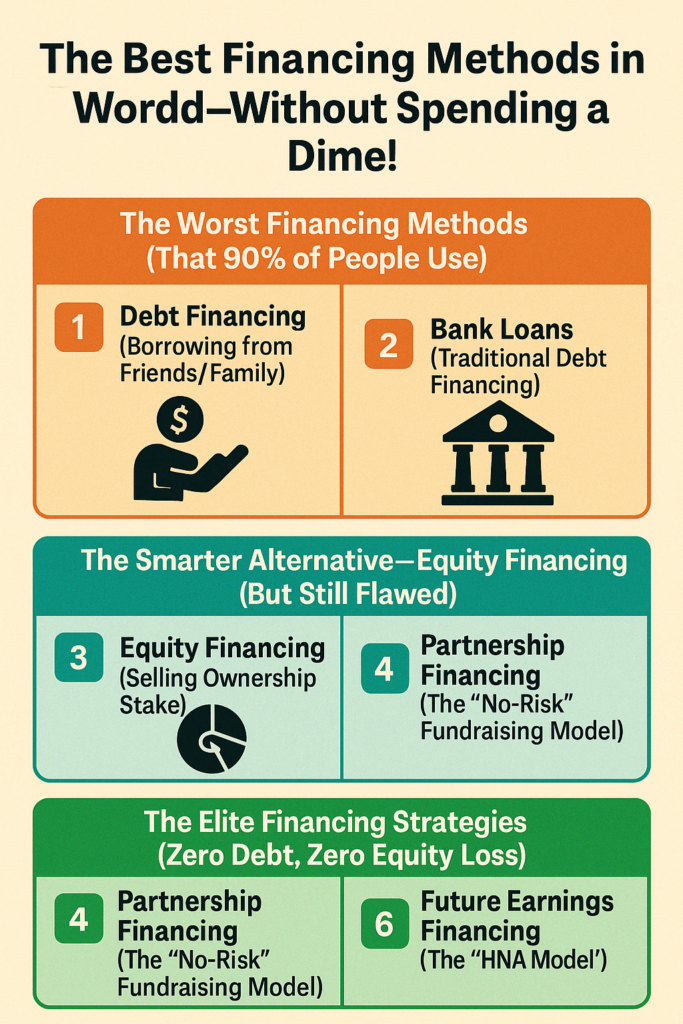

Most people rely on debt or equity financing—yet both come with hidden traps. In reality, the wealthiest entrepreneurs use smarter, safer strategies that don’t require repayment, risk, or loss of control.

Let’s break them down.

🚫 The Two Most Dangerous Financing Methods

1. Borrowing from Friends & Family

- How it works: Ask loved ones to loan you money.

- Why it’s risky: If your venture fails, you don’t just lose money—you damage relationships that may never recover.

- Real talk: These loans often lack formal terms, and when repayment fails, trust breaks down.

📉 Reality check: A failed business is painful. A failed relationship over money? Devastating.

2. Bank Loans (Traditional Debt Financing)

- How it works: Borrow from banks using personal or business assets as collateral.

- Downside: You owe fixed payments every month—regardless of whether your business is thriving or floundering.

- Worst case: Default can mean foreclosure, bankruptcy, and losing everything you’ve built.

❗ Key point: Debt amplifies risk, especially for first-time founders or businesses without stable revenue.

⚖️ A Common Upgrade: Equity Financing

3. Equity Financing (Selling Shares to Investors)

- How it works: Sell ownership in your company in exchange for capital.

- Upside: No loan repayments, and investors may offer mentorship or connections.

- But…

- You lose control. Investors may overrule your decisions.

- You give up a slice of your future profits—forever.

- Early-stage businesses without proven traction struggle to attract quality investors.

🔎 Insight: Equity is often irreversible. Once you give it away, it’s gone.

🚀 The Elite Alternatives: Zero Debt, Zero Dilution

Smart entrepreneurs don’t just ask “how do I get capital?”—they ask “how do I structure capital to serve me?”

💼 Zero-Cost Funding Pro

Find your ideal financing strategy—no loans, no equity loss, no stress

Include cash reserves and liquid assets

Based on last 6 months average

4. Partnership Financing

- Core idea: You divide your project into units (e.g., $1M into 30 parts at ~$33,000 each).

- Offer partners:

- Deep discounts on your future services

- Priority access or credit balances

- Small profit shares

- Referral bonuses

- Full refunds if they bring in more partners

Why it works:

- No legal debt

- No investor pressure

- No loss of equity or control

- Each partner becomes your advocate and marketer

💡 Used by: Franchise networks, digital course creators, and scalable service-based businesses.

5. Revenue-Based Financing (RBF)

- How it works: You get money now, and agree to pay back a small percentage of future monthly revenue.

- Advantages:

- No fixed payments—if your revenue is low, your payment is low

- No need for personal collateral

- You retain 100% ownership

📘 Ideal for: SaaS businesses, subscription models, or any company with predictable recurring revenue.

6. Future Earnings Financing (Inspired by HNA Group)

- How it works: Sell the rights to future revenue in exchange for capital today.

- Real-world example:

- HNA Group raised $25M by selling three years of future flight earnings at a discount.

- Bought one plane, used it to secure another via bank loan.

- Recycled capital repeatedly to grow into a $100B+ enterprise.

Why it works:

- You’re leveraging your future, not your assets.

- No personal guarantees or loss of control.

- Highly scalable if your business has long-term revenue visibility.

⚠️ Note: This strategy requires trust and transparency with sophisticated investors.

💡 Why Most Entrepreneurs Stay Stuck

| Method | Repayment Risk | Ownership Loss | Scalable? | Common Outcome |

|---|---|---|---|---|

| Friends & Family | High | None | Low | Relationship strain |

| Bank Loan | High | None | Medium | Debt burden |

| Equity | None | High | Medium | Loss of control |

| Partnership | None | None | High | Full control, shared upside |

| RBF | Low | None | High | Growth-aligned cash flow |

| Future Revenue | Low | None | Very High | Capital recycling |

Most founders never learn the last three options. That’s the real disadvantage.

🧠 Final Lesson: Be a Capital Architect

The difference between an average founder and a world-class entrepreneur isn’t just their product—it’s how they finance it.

❝ Smart founders don’t raise money to survive.

They structure capital to scale. ❞

- Banks play with debt

- Venture capitalists play with equity

- Elite founders play with future earnings, partnerships, and revenue flows

✅ Key Takeaways

- Debt creates pressure. Equity creates dilution.

- You don’t have to choose between losing control or living in debt.

- The most scalable models involve leverage without liability.

📣 What Should You Do Now?

Rethink the question:

❌ “How can I borrow money?”

✅ “How can I package what I already have into value for others—today?”

Because if you think like a borrower, you’ll always need permission.

But if you think like a capital architect, you’ll design your own growth engine.

🥳 Love My Content?

Fuel more free guides with a beer! 🍺

(Every sip makes the keyboard dance!)

Secured via PayPal • No account needed

SinoLoanHub: Expert Business Loan Solutions for North American Companies

SinoLoanHub: Expert Business Loan Solutions for North American Companies